- EMI CALCULATOR

- Eligibility CALCULATOR

- Harmony Import CALCULATOR

- STAMP Obligations CALCULATOR

- Income tax CALCULATOR

- Financial Brief Reads

- How-to Get Home financing

- Financial Taxation Experts

- CIBIL Rating Computation

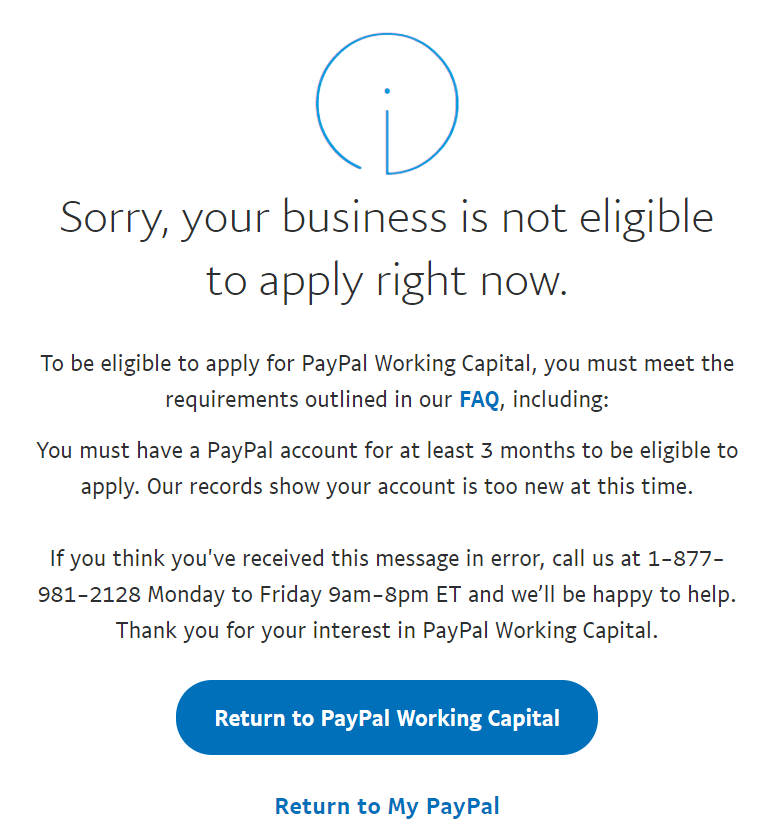

step one. Rejection regarding Application

One of the main dilemmas confronted of the Financial borrowers try rejection on very first stage. This may occurs because of discrepancies on borrower’s certificates you to definitely eters like ages standards, monetary status, paperwork etc. Hence, establish the qualifications requirements or other information before you fill out their app. As well as, offer perfect information plus the support paperwork due to the fact asked.

2. Increased Appeal Outgo

Whenever loan providers vow down EMIs, definitely understand the implications. A lower EMI 30 days can get translate into a high attract outgo while making your loan expensive. Therefore, have a look at and you may contrast the interest number for several EMIs having fun with a keen on line Mortgage EMI Calculator and you will negotiate for the best you can pricing. Further, Home loans are offered in the sometimes a fixed or floating notice speed. Determine each other form of notice having feasibility before you could select the top mortgage.

3. Insufficient Deposit

Depending on RBI advice, lenders is also loans up to 75% – 90% of the property price. They cannot fund the whole worth. Borrowers need to pay the remainder 10% – 25% while the a down payment to your possessions.

For instance, when you need to get a house really worth Rs.60 lakh, you can secure loans up to Rs.forty eight Lakh. The balance matter, that’s, Rs.12 Lakh needs to be reduced as the a down payment of your discounts pond. As the lending norms vary across lenders, check this type of criteria ahead of time and you can arrange for the mandatory money therefore that you do not are unsuccessful.

cuatro. Factors Related to Judge and you can Technical Assessment

Any assets you seek to buy which have a construction financing experiences rigid judge and you may tech examination. Authoritative lawyers check out the possessions and examine this new court documents instance the latest profit action, assets strings, assets chart, etc. to possess credibility. When they get a hold of anything suspicious, a research was approved on the perception, predicated on and that, loan providers could possibly get refute the loan app.

Lenders together with do technology confirmation of the house towards assistance of architectural engineers. They gauge the strengthening framework according to research by the assets map. In case there is deviations or any other facts, they may eliminate its valuation that will perception your own dominant matter; and you also ount at higher interest levels.

5. Inability to meet up new FOIR

A predetermined responsibility to help you money proportion (FOIR) denotes the new ratio out-of EMIs for the websites month-to-month earnings. Loan providers might be unwilling to extend finance for those who have an unfavourable FOIR. They incorporate FOIR predicated on your earnings. High-salaried candidates should be accepted for a financial loan even when the EMI constitutes 50% – 60% of the earnings at your fingertips. Whereas, people with a small paycheck is always to make sure the EMI does not exceed 30% – 40% of the earnings.

All financing candidate must spend an operating commission off right up so you can cuatro% of the loan amount + GST while the appropriate. Although some lenders are courtroom and you may technology can cost you within their processing costs, others will most likely not take action. Feel really wary about just what particularly charge or any other a lot more loan costs include in order to factor all of them to your complete borrowing costs.

seven. Problems with Term Deeds and NOC Documentation

A zero Objection Certification (NOC) from local authorities is needed with the beginning of every strengthening framework. NOC papers and you will term deeds have to be provided as per the lender’s given structure to have convenient mortgage handling. Completely wrong documentation, mistakes into the possessions information, forged records etc can prove to be a problem for the verification processes. Which, make sure right paperwork one which just complete all of them.

Finding your way through Your own Homeownership Journey

To quit people hurdles via your financing acceptance, recall an average complications with Mortgage brokers you to definitely consumers generally speaking deal with or take preventive strategies. For every single bank could have her gang of prerequisites one consumers have to complete to qualify for a houses financing. Look-up the various terms and conditions and the current market style and come up with advised conclusion.