Purchasing a home is a big milestone for most people, and it is possibly followed by the necessity to have property loan to invest in the purchase. The choice to prepay your residence financing have each other short-term and you may much time-term economic effects. Before carefully deciding that matches along with your financial specifications, you must equilibrium the huge benefits and downsides.

In this weblog, we’re going to go through the advantages and disadvantages off prepaying their mortgage. We’re going to glance at the possible experts, for example lower interest will set you back, large fico scores, and you may economic freedom. On the other hand, we shall coverage the newest downsides, for example prepayment charges, death of liquidity, and lower income tax positives.

We are going to familiarizes you with a useful tool to create an informed decision: our home financing prepayment calculator. It calculator assesses the newest economic feeling out of prepaying your residence mortgage, that delivers a better concept of the potential offers due to the fact really since influence on your loan tenure.

Benefits of Prepayment out-of Home loans

- Down attract burden: The most significant benefit of prepaying your financial is that it does greatly reduce your appeal stream. The sooner you pay out of the loan, the newest less attract you are going to need to pay along the label off the borrowed funds.

- Most useful credit rating: Repaying your own financial early will help you to enhance your borrowing rating. Once you pay your loan early, the credit use ratio drops, and that improves your credit rating.

- Monetary independence: Paying down their financial early can supply you with monetary versatility. You will have more income to invest in other places after you have paid down the loan, like stocks, mutual fund, and other home.

Downsides of Prepayment regarding Lenders

- Prepayment penalties: Specific banks charge a good prepayment punishment for individuals who pay the family loan till the label is actually right up. It punishment can offset the advantages of prepayment, thus ensure together with your bank prior to good prepayment.

- Exchangeability loss: For many who utilise your coupons to pay off your home loan, you will reduce exchangeability. This might be a negative if you would like money having an disaster otherwise a good investment.

- Less taxation positives: Once you prepay the home loan, your taxation gurus is faster. You could subtract the interest paid back on your own home loan from the taxes, and you will prepayment reduces the appeal americash loans Woodbury Center payable, hence decreases the taxation professionals.

Playing with a home loan Prepayment Calculator

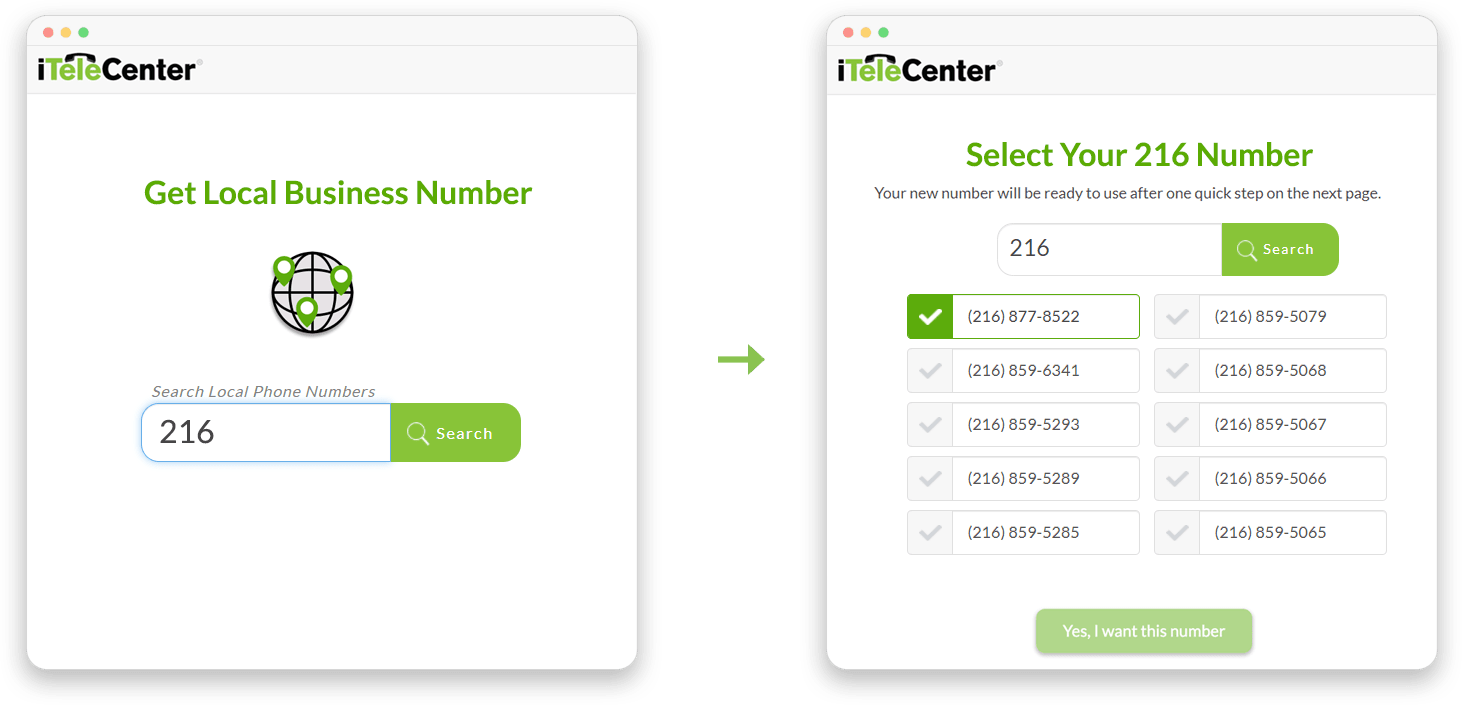

A home loan prepayment calculator try a useful equipment having expertise the new economic negative effects of prepaying your own financial. It includes comprehensive details about prospective coupons, mortgage period cures, and also the impression off prepayment charges, in the event the applicable. Is a step-by-action method to effortlessly using property mortgage prepayment calculator:

- Gather the appropriate guidance: Prior to with the calculator, gather the required factual statements about your home mortgage. Which discusses the a great loan balance, left loan title, interest rate, and any prepayment charges implemented by the bank.

- To find a trusting mortgage prepayment calculator: Choose a legitimate web source otherwise a beneficial calculator given by the financial or lender. Be sure the latest calculator produces right abilities.

- Familiarize yourself with the results: Once you’ve input the right recommendations, this new calculator will create overall performance according to the pointers you have provided. It does leave you advice including the it is possible to savings on desire, the latest less loan identity, and also the feeling out-of prepayment penalties on your own overall discounts.

Home financing prepayment calculator makes you create a knowledgeable decision that is in keeping with debt needs and you will enhances your own masters just like the a resident.

For those who have spare money and want to lower your desire load and you will improve your credit rating, prepaying your house loan can be a solution. not, it is vital to measure the disadvantages, such as for example prepayment penalties and you can liquidity losings. Making an educated choice, use home financing EMI calculator that have prepayment and you will speak with their financial before generally making people prepayments.